Combining your super

Combining your super is easy!

It’s easy to forget about old superannuation accounts. That’s why over a third of all Australians have more than one super account.

Multiple super funds could mean duplicate fees! Protect your hard-earned super money from being eroded by duplicate fees.

At Professional Super, you can combine your super accounts in minutes.

- 1Join Professional Super

- 2Add your Tax File Number

- 3Use our 'Find or combine my super' feature

Transparent. Simple. Organised. The way super should be.

If you’re like many young professionals, you’re probably working full time, balancing your social life with your career, at the same time as trying to save for the future.

Professional Super is built for young professionals who are results focussed and time poor.

We keep things simple:

- A loyalty discount program that starts when your balance reaches $1,000

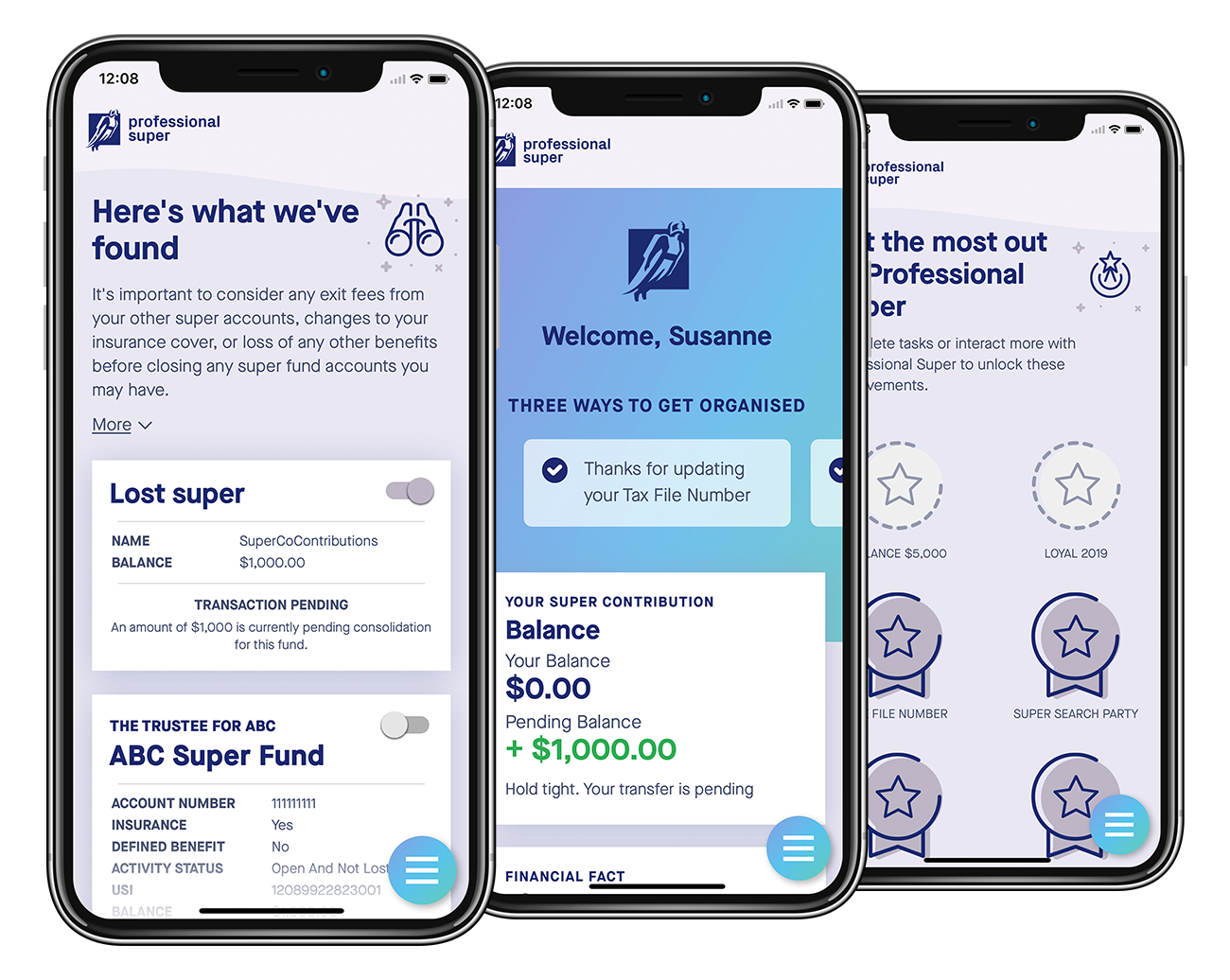

- Keep track of your funds with our fully featured app

- We’ll help you save for your first home with the First Home Super Saver Scheme

- Joining only takes 2 minutes

Watch your money grow with our fully-featured app

We’ve created a fantastic app that puts your money at your fingertips 24x7, so you can keep track of your money.

- Check your balance and if your boss has paid your super

- Use the 'Find or combine my super' feature to find lost and old super accounts.

- Set up regular deposits to save for your first home

Helping you save for your first home

We've made it easy to save for your first home using your super account.

Thanks to the governments First Home Super Save Scheme you can now use your super account to save for your first home!

We'll help you set up regular transfers into your account, set savings goals and keep track of your progress.

Why use super to save for a home?

- 1Earn more money - money saved using the First Home Super Saver Scheme earns interest at the Shortfall Interest Charge, this could be more than you'd earn in a savings account. - 7.17% vs 3.85% p.a 1.

- 2Save tax - super is taxed at 15%. Interest earned in a savings account is taxed on your personal income tax rate.

- 3Savings discipline - you can't touch your contributed savings until you're ready to buy a home.

1. As at May 2025 the earnings rate for First Home Super Saver Scheme withdrawals is 7.17% which we compared to the RBA's cash rate of 3.85%, which is assumed to be equal to the interest earned on a bank account.