Make a personal contribution by 5pm on the 24th of June 2025 to ensure it is received in your account this financial year. This is important if you are eligible to claim the government co-contribution or a tax deduction for personal contributions.

Save for your first home using super

The First Home Super Saver Scheme (FHSSS) is an initiative to allow you to save money in your super account to go towards your first home deposit.

Overview of the scheme:

- ●You can voluntarily contribute up to $50,000 to your super account* (up to $15,000 per financial year) to go towards a deposit for your first home.

- ●When you are ready to purchase your home, you can withdraw up to $50,000 in contributions plus associated earnings, less any taxes.

Eligibility for the scheme can be found on the ATO website.

The $50,000 limit on eligible contributions will only apply to requests for FHSS determinations made from 1 July 2022. The previous $30,000 limit on eligible contributions will apply to requests for FHSS determinations made before 1 July 2022.

The benefits of saving for a home inside super

Super gets a special tax treatment. You generally only pay 15% tax on the earnings within super.

This is compared to when you save the same amount of money in a savings account. You will be required to pay tax on the interest earned, and this is taxed at your personal income tax rate (which increases as your salary increases, and can be up to 47%).

How to start saving

To begin the FHSSS, you will need to make additional contributions to your super.

These must be voluntary contributions which can be added by making personal contributions or by salary sacrificing. You cannot access employer contributions through this scheme.

There are two methods to start:

1. Personal contributions - transfer from your bank account

This is the easiest method and allows you to stay in control of how much and when you contribute.

If you are a Professional Super member, log in and make sure you have added your Tax File Number to your account. Then, you’ll be able to make personal contributions.

You may also be able to claim a tax deduction for these personal contributions – see the ATO website for more information.

2. Salary sacrifice contributions - set this up with your employer

Speak to your employer or HR manager about setting up salary sacrifice contributions. You can normally do this if the total of your employer’s contributions, plus your salary sacrifice contributions is less than $30,000 p.a. (FY 2024-25).

These contributions are made from your before tax salary, so the contributions won’t incur income tax and are instead taxed at a concessional rate of 15%.

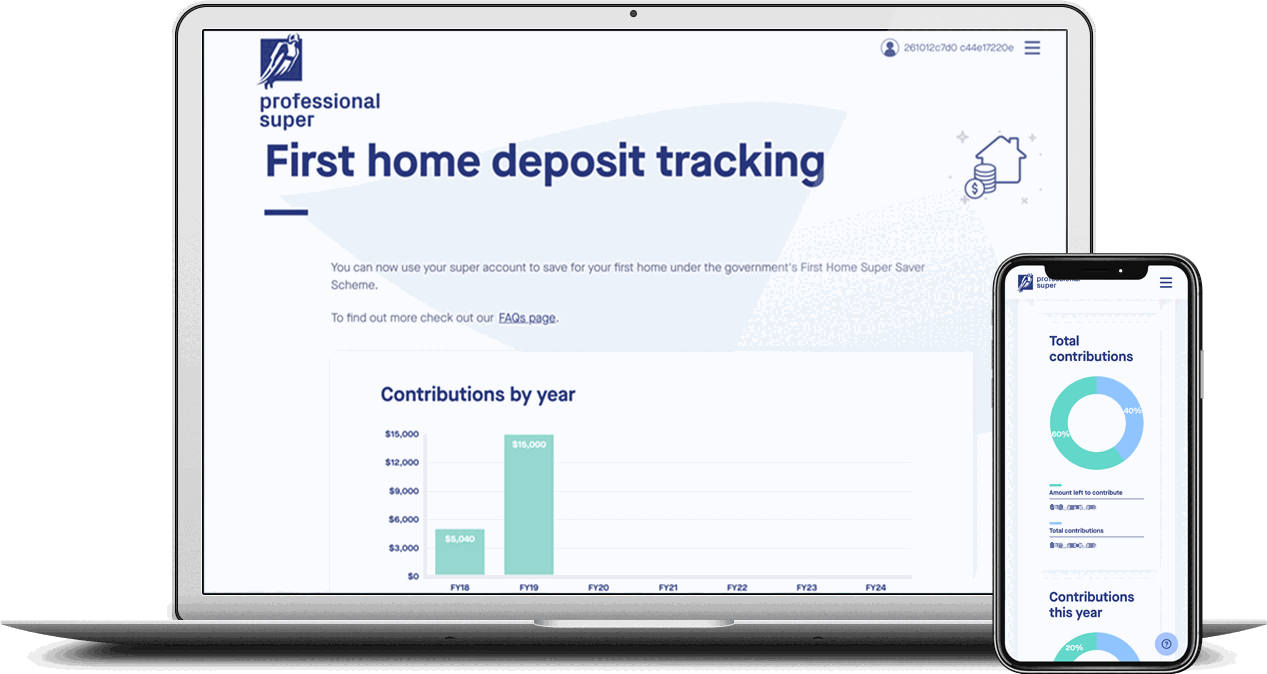

The First Home deposit tracking

We’ve made it easy for you to track your contributions for each financial year and your total contributions.

Professional Super has a First home deposit tracking feature that you can access when you login or on the app.

How much can I save using super?

You can add up to $15,000 per financial year into your super account to go towards a deposit. The maximum amount you can save is $50,000 for your first home deposit.

How do I access my savings?

When you are ready, you can apply to the ATO to request a determination. You do this using your myGov account if you’ve linked it with the ATO.

The determination will tell you the maximum amount you’re able to access under the FHSSS.

Once you’ve received the determination you can then apply to have your super released.

It’s important to consider the time it takes to receive the determination, the conditions of the scheme and the time it could take to receive your money. Read more on the ATO website.

If you have any questions about the determination and release of funds, it is best to contact the ATO as they handle this process.

Are there eligibility requirements?

Yes, to be eligible to have the deposit released:

- a.You must be 18 years of age or over – however you can start saving at any age;

- b.You must be intending to purchase a residential home or land you intend to build a home on;

- c.You must not previously have owned property in Australia

- d.You must not have previously accessed your super under the FHSSS arrangements

- e.You must also live, or intend to live, in the premises you are buying as soon as practicable; for at least six months of the first twelve months you own it, after it is practical to move in.

For more information check out the ATO website.