Rewarding loyal members

Join the growing community of professionals getting their super organised

Save for your future with Professional Super

Like many young professionals you’re probably working full time, balancing your social life with a career, at the same time as trying to save for the future.

Professional Super is built for young professionals who are results focussed and time poor.

We keep things simple, at Professional Super we’ll help you:

- Get your super organised.

- Keep one super fund wherever your career takes you.

- Save for your first home the smarter way.

- Know what’s happening with your money - transparent.

- Learn about money - knowledge is power.

Helping you save for your first home

We’ve made it easy to save for your first home using your super account.

Thanks to the government’s First Home Super Saver Scheme you can use your super account to save for your first home!

We’ll help you set up regular transfers into your account, set savings goals and keep track of your progress.

There are two key advantages of saving in your super account:

- 1Tax effective - super is only taxed at 15%.

- 2Money is professionally invested.

Time to get your super organised

If you haven’t tidied up your old super accounts now’s the time to get organised. If you have multiple super accounts you could be spending hundreds of dollars a year in fees without even realising.

We’ve made it easy to find any lost or old super accounts you have and transfer them into your professional super account.

There are no paper forms or long documents to complete, it’s all online. It only takes a few minutes - the hardest part is finding your TFN.

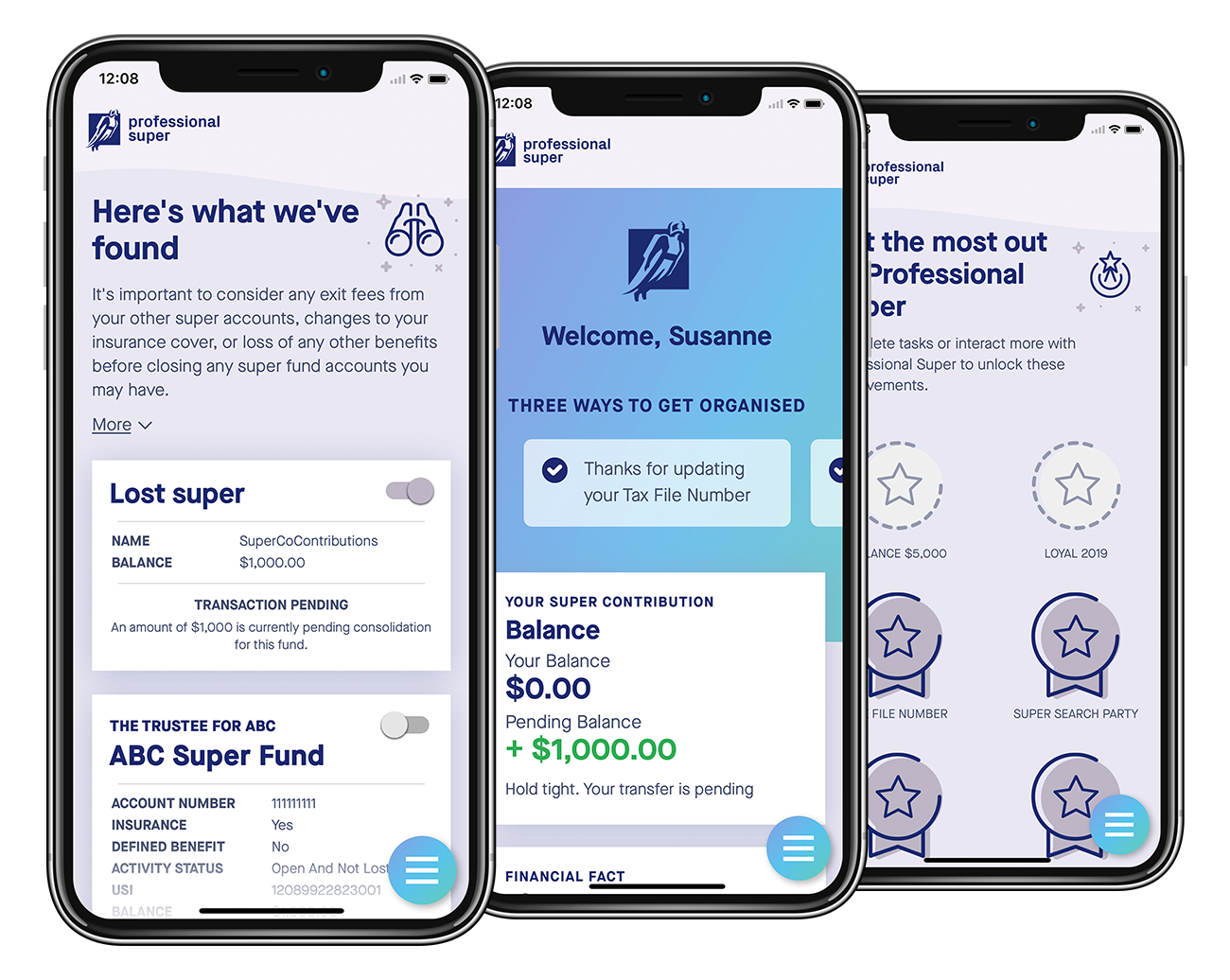

Watch your money grow with our fully-featured app

We’ve created a fantastic app that puts your money at your fingertips 24×7, so you can keep track of your money.

- Set up regular deposits to save for your first home

- Change how your super is invested

- Use the 'Find or combine my super' feature to find lost and old super accounts

Still studying? Get started with Student Super

Student Super is our student brand. It has educational benefits that are better tailored to students.

Student Super helps students protect their early balances and get ready for their first job with zero admin fees for balances under $1,000.

See our Fees & discounts page or PDS for details.

When you start full-time work you can change over to Professional Super. You’ll still be in the same fund with the same fee discounts.

We’re rewarding loyal members

Our loyalty discount program rewards members who stay with the fund, including after you graduate.

You're automatically enrolled in the program when your balance reaches $1,000.

If you receive a contribution every 12 months into your super account, you will be eligible for the fee rebate.

There are seven membership levels with percentage-based admin fee discounts increasing over time.

Loyalty Discount Program

Level

Year

Bronze

1

Bronze Plus

2

Silver

3

Silver Plus

4

Gold

5

Gold Plus

6

Platinum

7